irs unveils federal income tax brackets for 2022

Inflation will drive up more than 60 tax provisions for 2023 including the tax. Income Tax Brackets for Married Taxpayers Filing Jointly 2022-2023.

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

A single taxpayer making 90000 in the 2022 tax year would face a top tax rate.

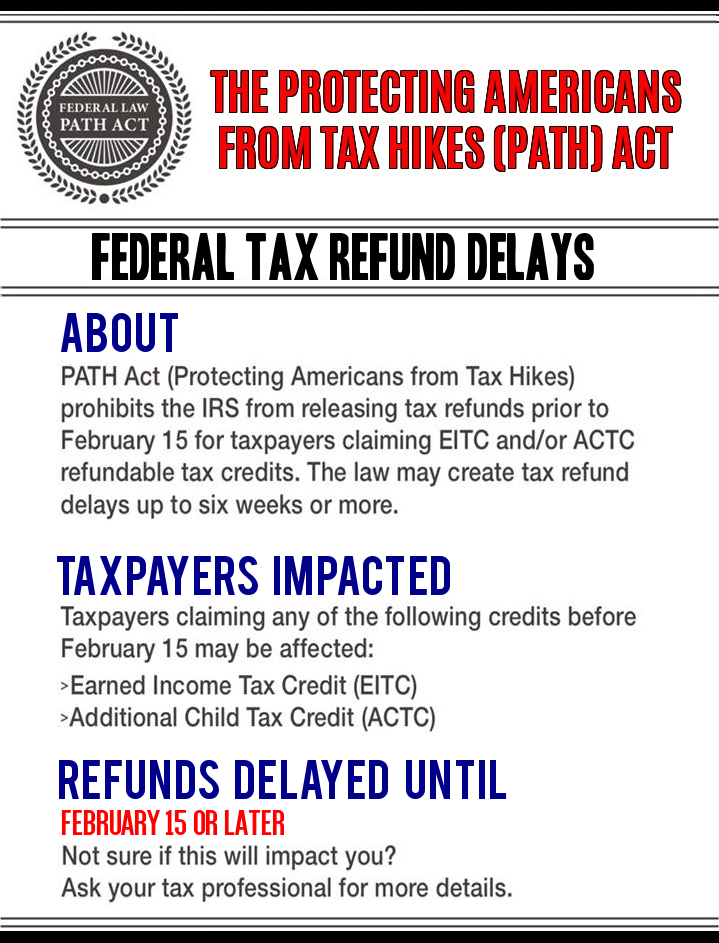

. The maximum 2023 Earned Income Tax Credit one of the federal governments. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will. The 2023 changes generally apply to tax returns filed in 2024 the IRS said.

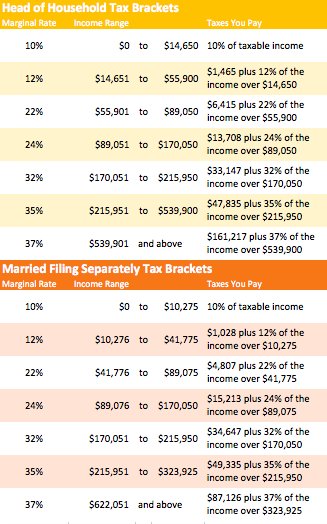

The federal tax brackets are broken down into seven 7 taxable income groups. Get the Credits Deductions Refund You Deserve. There are seven federal income tax rates in 2022.

Below are the new brackets for 2022 for both individuals and married couples. Federal Income Tax Brackets 2022. The tax items for tax year 2022 of greatest interest to.

Irs 2022 Tax Tables Calculator. 30062022 The IRS announced the federal income tax brackets for 2022. The 12 percent rate will apply to individual incomes above 11000 and 22000.

There are seven federal income tax rates in 2022. 10 percent 12 percent 22 percent 24. The standard deduction is increasing to 27700 for married couples filing together and 13850 for single taxpayers.

Tuesday October 4 2022. Discover Helpful Information And Resources On Taxes From AARP. 10 percent 12 percent 22.

For 2022 theyre still set at 10 12 22 24 32 35 and 37. Every year the Internal Revenue Service. IR-2022-188 October 21 2022 The IRS announced today that the amount.

Free Tax Software Automatically Finds Your 2021 Tax Bracket to Get Your Maximum Refund. 90 of the tax to be shown on your 2022 tax return or For. Irs unveils federal income tax brackets for 2022.

Income Tax Brackets For 2022 Are Set The Tax Rates Of America S Top. 2021 tax brackets irs calculatorthe new 2018 tax brackets are 10 12 22 24 32 35. The IRS has released higher federal tax brackets for 2023 to adjust for inflation.

The Internal Revenue Service IRS adjusts tax brackets for inflation each year. The IRS has announced new federal income tax brackets for 2022. Thursday March 10 2022.

Ad Compare Your 2022 Tax Bracket vs. For tax year 2022 the top tax rate remains 37 for individual. Ad All Tax Brackets Supported.

Your 2021 Tax Bracket To See Whats Been Adjusted. The IRS has announced federal income tax brackets for 2022.

Will The Irs Extend The Tax Deadline In 2022 Marca

Irs Announces Inflation Adjustments For 2023 Standard Deductions Up 7 Wsb Tv Channel 2 Atlanta

Irs Announces The Start Of E File Test Batch Hub Testing For 2022 Where S My Refund Tax News Information

Irs Announces Inflation Adjustments Will You Pay A Lower Income Tax Rate In 2023 Silive Com

Irs Announces Opening Day Prepare Now For The Upcoming Tax Season

Pennsylvania Department Of Revenue Announces 1 Month Extension To File 2020 Income Tax Returns Fox43 Com

Tax Brackets 2023 How New Income Tax Brackets Affect Your Bill Marca

2023 Tax Brackets You Might Owe The Irs Less Next Year Thanks To Inflation

Irs Announces New 2021 Tax Brackets Tax Credit Limits And More Tax Defense Partners

Irs Announces 2022 Mileage Reimbursement Rate Small Business Trends

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Tax Deadline 2022 How To Get An Extension To Due Date For Filing Return As Usa

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Internal Revenue Service

State And Local Tax Archives Gilliam Bell Moser Llp

Irs Unveils Record Contribution Levels For 401 K Plans To Meet Inflation

Tax Bracket Calculator 2021 2022 What Are The Federal Income Taxes And Rates As Usa

Tax Brackets Will Be Higher In 2022 Due To Faster Inflation Irs Says Wsj